Have you not filed your Arizona tax returns for previous years and have back taxes?

Have you not filed your Arizona tax returns for previous years and have back taxes?

If so the Arizona Department of Revenue (AZDOR) may have some relief for you.

From September 1, 2011 to October 1, 2011 AZDOR has a program called Arizona Tax Recovery. Under this program they will allow you to file and pay back taxes and a reduced rate of interest for late payment. In addition they will waive or abate any civil penalties that have or could be charged for the period and not take any action against you for the period.

You do give up some rights agreeing to take part in the program. These include a waive of the right to any refund or credit for the period covered by the program. AZDOR will also still be able to audit the returns you file.

Returns covered by the program are income tax returns for years starting on or after January 1, 2004 and ending before January 1, 2010. For taxes like sales tax it is for tax periods starting on or after January 1, 2005 and ending before January 1, 2010.

The program covers the full range of taxes including Individual and Corporate income taxes, Sales and Use tax, Withholding, Partnership taxes and Tobacco and Liquor taxes. City taxes are not included. 2010 Returns are also not included.

Some taxpayers cannot participate in the program including those with any existing liability for the period, received a notice or bill from AZDOR, has had a final audit for the period, or are party to any criminal investigation.

To submit an application for the program you need to complete form 10747 and mail it with all filed returns and other supporting information by October 1, 2011.

Given that if you decide to participate in the program you give up some rights it is important to get professional advice before you submit your application.

More information about the program is available at the following links.

AZDOR Tax Recovery Page

Form 10747 (pdf)

Form 10747 Instructions (pdf)

If you need any assistance or advice about participating in Arizona Tax Recovery call us on (480) 363-4808 or email us.

Small Business Saturday is on Saturday November 26, 2011. It is a day dedicated to small businesses that are the back bone of our economy.

Small Business Saturday is on Saturday November 26, 2011. It is a day dedicated to small businesses that are the back bone of our economy. Cranmere Accounting & Tax Services

Cranmere Accounting & Tax Services

Have you not filed your Arizona tax returns for previous years and have back taxes?

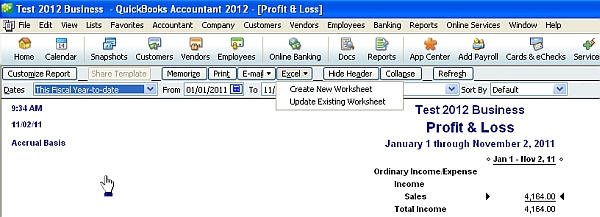

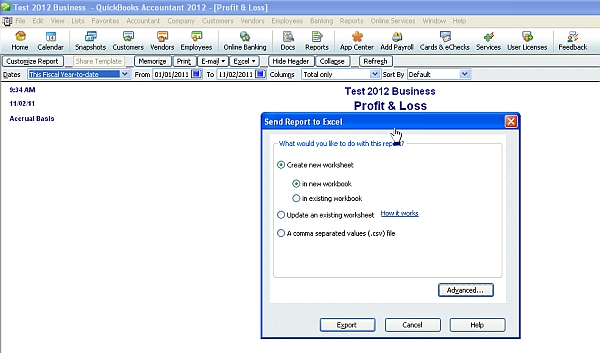

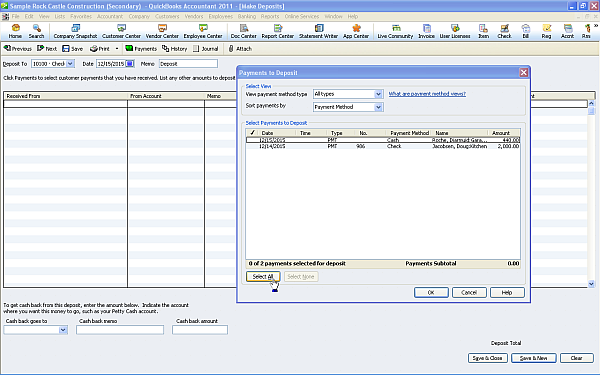

Have you not filed your Arizona tax returns for previous years and have back taxes? Put a tick next to the customer payments you are depositing then click OK.

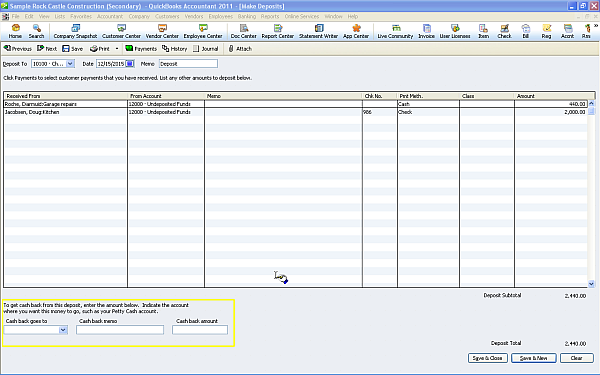

Put a tick next to the customer payments you are depositing then click OK. If you held some of the cash back from the deposit the details for this can be entered in the highlighted area above. When you are happy with the deposit click Save & Close and the deposit will be posted to the bank account.

If you held some of the cash back from the deposit the details for this can be entered in the highlighted area above. When you are happy with the deposit click Save & Close and the deposit will be posted to the bank account.