The Undeposited Funds Account is one of the most useful accounts in QuickBooks®. If used properly it will save you a lot of hair pulling and tears when you come to reconcile your bank account. It is also a useful control tool to monitor the business cash accounts.

The Undeposited Funds Account is set up automatically when you first post a payment for a sales invoice or sales receipt. It acts as a holding account until the cash, checks or credit card payments are actually deposited into the bank account. Think of it as the representation of your petty cash tin or safe in QuickBooks®.

To make sure that all customer payments are posted to the Undeposited Funds Account you will want to set one of the preferences. This is found at Edit|Preferences|Payments|Tick the “Use Undeposited Funds as a default deposit account”.

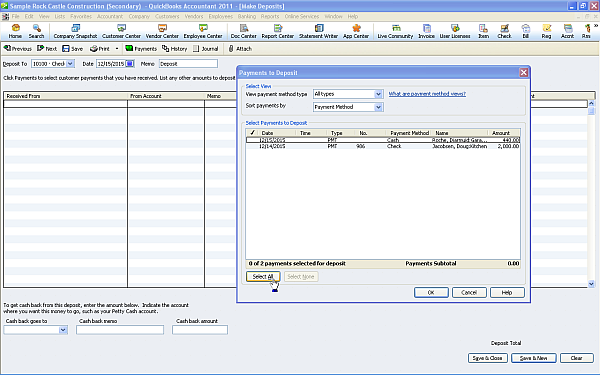

When you have deposited the customer payments in to the bank account you can enter this deposit in QuickBooks® by going to Banking|Make Deposits. That will bring up the following screen showing all the customer payments that are in the Undeposited Funds Account.

Put a tick next to the customer payments you are depositing then click OK.

Put a tick next to the customer payments you are depositing then click OK.

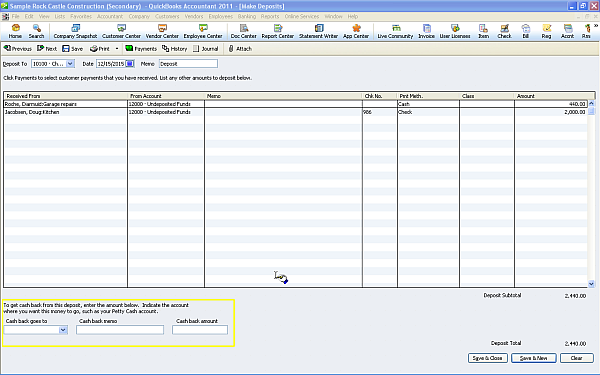

If you held some of the cash back from the deposit the details for this can be entered in the highlighted area above. When you are happy with the deposit click Save & Close and the deposit will be posted to the bank account.

If you held some of the cash back from the deposit the details for this can be entered in the highlighted area above. When you are happy with the deposit click Save & Close and the deposit will be posted to the bank account.

To get the best use out of the Undeposited Funds Account remember the following:-

- Post all customer payments to the Undeposited Funds Account

- Enter any cash held back on the Make Deposits screen

- Regularly review the Undeposited Funds Account to make sure the balance in it reconciles to unbanked cash, checks and credit card payments

- Regularly reconcile your bank accounts to the bank statements

If you need help setting up or using your Undeposited Funds Account please call (480) 363-4808.

Posted By Mark Smith

Mark Smith, EA is an Enrolled Agent and accountant with over 30 years tax and accounting experience. He is the owner of Cranmere Accounting and Tax Services LLC. He can be contacted on (480) 363-4808 or by email at info@cranmereaccountingandtax.com if you need assistance with any of the above.

Cranmere Accounting & Tax Services

Cranmere Accounting & Tax Services

3 Responses to QuickBooks® Undeposited Funds Account